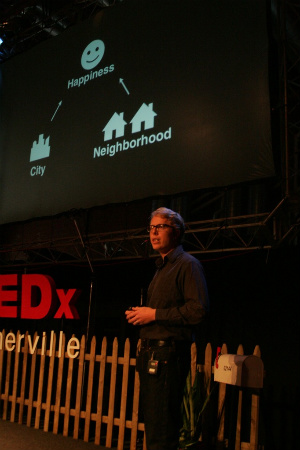

Dan Hadley, City employee of Somerville who worked on the happiness survey. ~Photo by Andrew Firestone

By Andrew Firestone

One thing that TEDx Somerville did well, perhaps better than any other conceivable circumstance, was that it really allowed Somerville’s hidden jewels to shine. These are all members of the community and all of them, all of them, were moved by the idealist streak embedded in twenty-first century techniques.

Here are a few more snippets from the talks. Don’t forget to visit tedxsomerville.org for the full talks.

In this edition, we see Dan Hadley, City employee of Somerville who worked on the happiness survey, and Aatish Salvi, director of non-profit Compass Working Capital, specializing in low-income finance.

Dan Hadley, “”Can you make your city happier? “

One of the coolest things, though, about asking people to rate their happiness is that you can take the data and compare it to a whole bunch of real stats to see if there are any correlations. In our happiness survey, we also asked about neighborhood satisfaction, a variety of city services, and satisfaction with the City overall. Once the data were crunched, what we found was that things were correlated: that is, the more satisfied that city intended [the residents] to be, the happier.

Can local governments really make a difference in peoples’ lives? I say yes, and I say this for a few reasons. I will point correlation is not causation, so it could be that happier people just respond more positively. But I think there are other factors at play.

Ultimately, I would argue that, whether or not the City of Somerville can have an immediate impact of it’s residents happiness, whether or not governments can do that, it could work to collect this kind of data. We know all about the economy and how it impacts the open markets. We collect lots of demographic statistics so that we’ll know things about childhood obesity and even airplane noise. Yet Somerville was the first cities in the US to collect data on something as central as emotional well-being.

This is my vision of the future. In addition to all the maps that show us area-income and the foreclosures that are happening and all the important data, we’ll have maps of communities that show us where people are the happiest.

Social science will flourish. Mayors will seek to boost their happiness scores, and a small city next to Boston will have led the way.

Aatish Salvi “From Food Stamps to Home Ownership”

Now let’s take a look at how we help Americans build assets to accumulate wealth. We spent $300 billion in general asset system all of which was given in the form of tax deductions and tax breaks. Pop quiz. What does a family of living on $22,000 a year not have a whole lot of? Taxes. We used to deduct anything. We spent 10 percent of the total on low income families. Now if we take out the educational incentives, healthcare, we really only spent point three percent, a third of the percent of the total, helping low-income families spend money.

On the other hand, we spent over half of the amount helping the top five percent of families get richer. What does this say about our values?

It’s not just that we don’t encourage low-income families to save, but the majority of the welfare programs that benefit them are means tested and will actively discourage them from saving by pulling the benefits out from underneath them if they put together even the smallest of financial cushions.

There’s a problem with this message. You cannot consume your way out of being poor. Your children cannot inherit your food stamps. But if you have no assets, if you have no savings, they will inherit your poverty. Assets are the engine of economic mobility, and we have broken that engine and we have shut down the American Dream.

How do we do it? Community outreach. The first step is getting communities holding workshops with times and places that are convenient to working low-income families there. Asset building is second. Get hold of the few federal programs that do exist that help them build assets, most of them probably they’ve never heard of. The third and final piece: provide them with firm financial coaching and education… help them get out of bad predatory credit card debt and make the credit system work for them, that can help them figure out how to save.

What if you could build a business that provided financial services for low-income families and pull them out of poverty at the same time? We have a choice: we can choose to provide low-income families with the same financial tools, opportunities and knowledge that we possess. And if we do this, we can do an audacious thing: we can make the poor wealthy and we can bring back the American Dream.

Reader Comments